Pharma

The pharmaceutical sector is a critical and rapidly changing industry that contributes significantly to advancing healthcare and enhancing lives. It includes companies engaged in researching, developing, manufacturing, and distributing pharmaceutical drugs and medications. Insurance plays a crucial role in the pharmaceutical sector by protecting against various risks and liabilities.

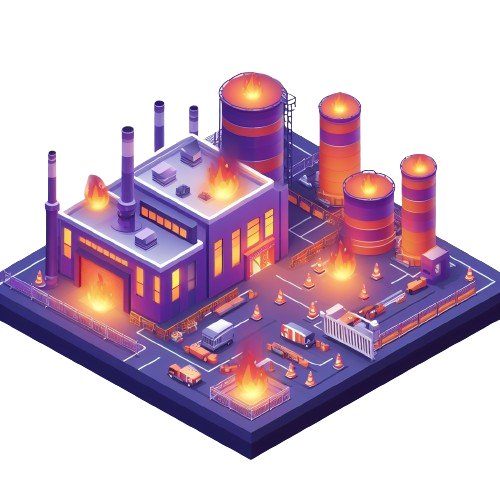

Industrial All Risk Insurance Policy

The policy includes coverage for losses stemming from any accidental, electrical, or mechanical failures caused by both internal and external factors, regardless of whether the machinery is active, idle, being dismantled, overhauled, or being reassembled at the original location

Clinical Trials Insurance

This policy will compensate the insured for all amounts beyond the deductible that they are obligated to pay as compensation for claims made by research subjects for bodily injury, including death, resulting from serious adverse events occurring after the retroactive date.

Directors & Officers Liability Insurance Policy

This Policy provides financial protection for directors and officers of a company (such as its executives and board members) in case they are personally sued for alleged wrongful acts or decisions made in the course of their duties. This insurance is designed to cover legal defense costs, settlements, and judgments that may arise from lawsuits targeting these individuals

Business Guard Insurance policy

Business Guard is an insurance product designed for business such as shops, lodging, health facilities, offices, restaurants, and educational facilities.Business Guard is also offered with coverage extension for your business, which can be tailored to your needs. The coverage can help you protect your business from unexpected risks and maintain stability for your business. Receive maximum protection with affordable premiums.