Commercial office and retail spaces

Insurance plays a vital role in the commercial and retail sectors by offering essential protection against a range of risks. Whether it’s coverage for property, liability, or business interruption, insurance safeguards assets and operations, ensuring financial security for businesses.

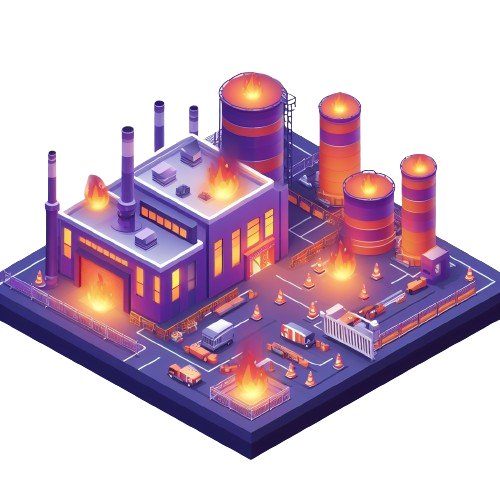

Standard Fire & Special perils Insurance Policy

"Property insurance provides coverage for physical assets, including buildings and their contents. It safeguards against damage caused by fire and other allied perils, which may include natural disasters or “Acts of God.” This type of insurance is crucial for protecting your valuable assets and ensuring financial security."

Machinery Breakdown Insurance Policy

The policy includes coverage for losses stemming from any accidental, electrical, or mechanical failures caused by both internal and external factors, regardless of whether the machinery is active, idle, being dismantled, overhauled, or being reassembled at the original location

Public Liability Insurance Policy

This policy provides coverage for your legal responsibility for damages, including accidental death, bodily injury, or property damage sustained by a third party. It also offers protection for any legal expenses incurred in these situations, provided there is prior approval.

Workers' Compensation Insurance Policy

Construction environments are naturally risky, and mishaps are a possibility. Workers’ compensation insurance safeguards against the financial impact of workplace injuries by covering medical costs and compensating for lost income, thus promoting the welfare of employees and adherence to legal obligations.

Business Guard Insurance policy

Business Guard is an insurance product designed for business such as shops, lodging, health facilities, offices, restaurants, and educational facilities.Business Guard is also offered with coverage extension for your business, which can be tailored to your needs. The coverage can help you protect your business from unexpected risks and maintain stability for your business. Receive maximum protection with affordable premiums.