Cement Industry

The cement industry holds immense importance in global construction and infrastructure development. Driven by factors such as urbanization, population growth, and infrastructural advancements, it plays a pivotal role in economic prosperity. As urbanization persists, the cement industry continues to be vital in sustaining modern societies and fostering a sustainable future

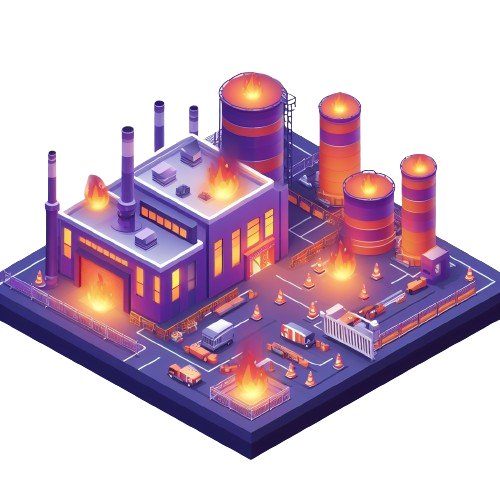

Fire Loss of Profits Insurance Policy

The policy extensively protects against the loss of Net Profit resulting from business disruptions caused by Material Damage to property from Fire and related dangers. Additionally, it encompasses fixed costs and the rise in operational expenses.

Machinery Breakdown Insurance Policy

The policy includes coverage for losses stemming from any accidental, electrical, or mechanical failures caused by both internal and external factors, regardless of whether the machinery is active, idle, being dismantled, overhauled, or being reassembled at the original location

Machinery Loss of Profits Insurance Policy

The policy extensively covers the loss of Net Profit due to business interruptions resulting from material damage to property caused by machinery breakdown. It also includes coverage for fixed costs and the additional expenses incurred in operations.

Industrial All Risk Insurance Policy

The Industrial All Risk Policy is an inclusive insurance plan that provides protection against damage to all kinds of fixed assets from unexpected events, with the exception of those specified in the “Exclusions” section. It is an all-encompassing risk policy, not limited to named perils, and it safeguards against a broad spectrum of potential risks.

Group Health Insurance Policy

Group health insurance Policy provides an affordable and tailor made healthcare solution for employees & their dependents with lower premiums and broader coverage compared to individual plans. The coverage is comprehensive, including hospitalization, outpatient care, and even maternity benefits. They Provide cover for pre-existing conditions with cash less facility for the Hospitalization. .

Workers' Compensation Insurance Policy

Construction environments are naturally risky, and mishaps are a possibility. Workers’ compensation insurance safeguards against the financial impact of workplace injuries by covering medical costs and compensating for lost income, thus promoting the welfare of employees and adherence to legal obligations.

Business Guard Insurance policy

Business Guard is an insurance product designed for business such as shops, lodging, health facilities, offices, restaurants, and educational facilities.Business Guard is also offered with coverage extension for your business, which can be tailored to your needs. The coverage can help you protect your business from unexpected risks and maintain stability for your business. Receive maximum protection with affordable premiums.